Florida’s sunny weather and scenic routes make it a haven for motorcycle enthusiasts. However, with the joy of riding comes the responsibility of being properly insured. Understanding the various types of motorcycle insurance policies available in Florida is essential—not just for legal compliance, but for your financial protection and peace of mind. Let’s explore the various coverage options and their implications for riders in the Sunshine State.

Understanding the Basics of Florida Motorcycle Insurance

Florida has unique insurance requirements compared to other states. Unlike automobile drivers, motorcyclists in Florida are not required by law to carry motorcycle insurance to register their bikes. However, if you’re involved in an accident, you must be able to show proof of financial responsibility. This means many riders opt for insurance to avoid out-of-pocket costs or license suspensions after a crash.

Motorcycle insurance in Florida provides a safety net for both legal and financial reasons. While basic policies are available, they often only offer minimal protection. Understanding what your policy covers—and what it doesn’t—is vital before hitting the open road. Insurance providers offer a variety of options to tailor your policy to your specific needs and riding habits.

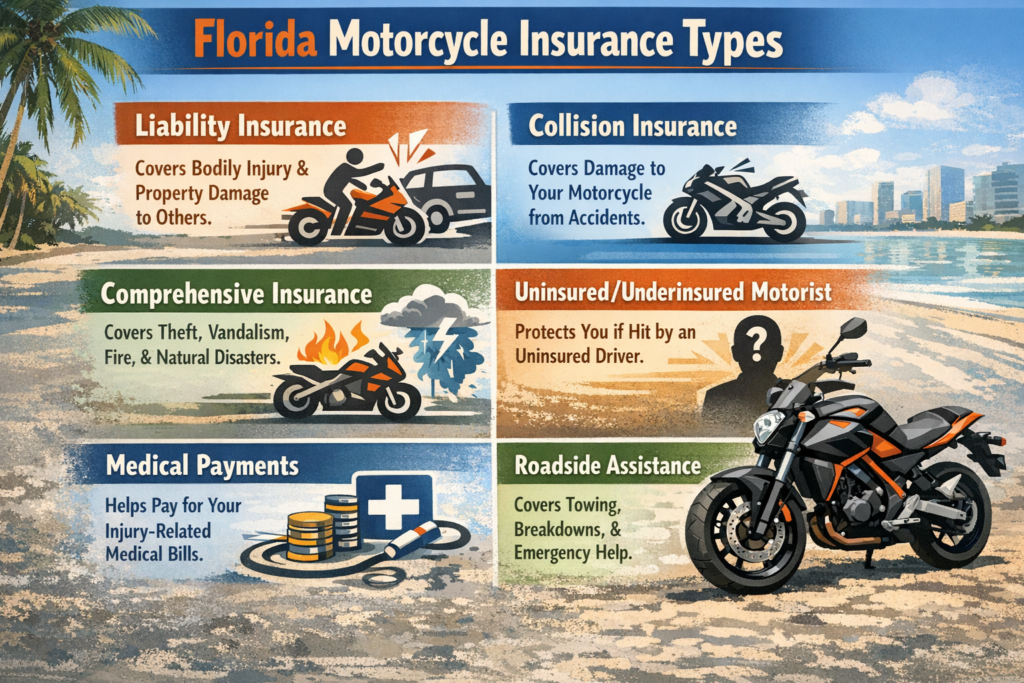

The types of coverage available range from liability protection to more comprehensive plans. Riders should carefully assess the risks they face and consider the coverage that will best shield them from potential losses. Taking time to understand the basics can help you make informed decisions and ride with greater confidence.

Liability Coverage: Protecting Yourself and Others

Liability coverage is the foundation of any motorcycle insurance policy. In Florida, bodily injury and property damage liability insurance are optional, but many lenders require it if you finance your bike. This type of coverage protects you if you’re at fault in an accident, covering expenses related to injuries or property damage caused to others.

Without liability coverage, you could be held personally responsible for medical bills, repair costs, and even legal fees. Given the potential severity of motorcycle accidents, these expenses can add up quickly. Liability insurance offers peace of mind, knowing that you have a financial safeguard in place should the unexpected occur.

Additionally, carrying liability coverage demonstrates financial responsibility, which can be crucial if you’re involved in a lawsuit or need to show proof of coverage after an incident. It’s an essential part of protecting not just your finances, but also your reputation as a responsible rider on Florida’s roads.

Comprehensive and Collision: What’s the Difference?

While liability insurance protects others, comprehensive and collision coverage focus on your own bike. Collision coverage pays to repair or replace your motorcycle if it’s damaged in a crash, regardless of who is at fault. This can be invaluable if you have a newer or high-value bike that would be expensive to fix.

Comprehensive coverage, on the other hand, protects your motorcycle from non-collision incidents. This includes theft, vandalism, fire, and even damage from Florida’s unpredictable weather. Comprehensive insurance is often paired with collision coverage for full protection, especially if your bike is your pride and joy—or your daily commuter.

Both types of coverage typically come with deductibles, so it’s important to weigh the cost of premiums against your ability to pay out-of-pocket expenses in the event of a loss. For many Florida riders, opting for comprehensive and collision insurance means greater peace of mind and less worry about the unexpected.

Uninsured Motorist Coverage in Florida Explained

Florida has a high rate of uninsured drivers, making uninsured motorist (UM) coverage an important consideration for motorcycle owners. UM coverage steps in to help pay your medical expenses, lost wages, and sometimes property damage if you’re hit by a driver who doesn’t have insurance or doesn’t have enough coverage.

Even though UM coverage isn’t required by Florida law, it’s strongly recommended. Especially for motorcyclists, who are more vulnerable to serious injuries in a crash. This coverage can also apply if you’re the victim of a hit-and-run accident, which, unfortunately, is not uncommon on Florida’s roads.

Choosing UM coverage is a proactive step towards shielding yourself from the financial consequences of another driver’s negligence. It’s worth discussing with your insurance agent to ensure you have adequate protection. Medical costs from motorcycle accidents can be substantial.

Optional Add-Ons for Enhanced Motorcycle Protection

Beyond the standard offerings, Florida insurers provide a variety of optional add-ons to further enhance your motorcycle protection. Popular choices include roadside assistance. This covers towing and emergency services if your bike breaks down, and accessory coverage for custom parts and equipment.

Medical payments coverage, or MedPay, is another valuable option. It helps cover medical expenses for you and your passengers, regardless of who is at fault. This can be particularly useful for riders who lack robust health insurance or want extra peace of mind.

Other add-ons, such as trip interruption coverage or coverage for personal belongings, can tailor your policy to fit your lifestyle and unique risk profile. While these extras increase your premium, many riders find the added convenience and security well worth the investment.

Conclusion

Navigating the complexities of motorcycle insurance in Florida can be daunting, but understanding your options ensures you’re protected both on and off the road. From basic liability to comprehensive plans and specialized add-ons, the right coverage gives you confidence to enjoy the ride. By evaluating your needs and working with a trusted insurer, you can customize a policy that keeps you safe.